Elizabeth Warren’s “Accountable Capitalism Act”: A Blueprint for Government Overreach and Economic Decline

Warren's reintroduced bill expands government control, empowers unions, and undermines free market principles, threatening innovation, economic growth, and individual freedom.

The Battle for America’s Economic Future

Elizabeth Warren’s “Accountable Capitalism Act” is more than a policy proposal; it marks a significant shift toward expanded government oversight, increased union influence, and a departure from free-market principles. Originally introduced in 2018, the bill’s reintroduction highlights Warren’s ongoing mission to embed progressive priorities into American corporate governance. Framed in the language of economic justice and corporate accountability, the proposal seeks to prioritize state-defined equity over market-driven efficiency.

At its core, this legislation represents a broader ideological contest: the progressive vision of centralized control and equity versus the free-market principles that have long fueled American innovation and prosperity. Warren’s approach reflects a deeper effort to reshape the nation's economic and cultural foundations, setting up a clash with the limited-government ideals embodied by the MAGA platform.

The Cultural and Ideological War

The progressive agenda, embodied in Warren’s proposals, emphasizes identity politics, equality of outcomes, and centralized oversight. These priorities are enforced through frameworks such as Diversity, Equity, and Inclusion (DEI) initiatives, Environmental, Social, and Governance (ESG) standards, and critical race theory (CRT). These mechanisms aim to reshape corporate governance and societal norms to align with progressive ideology.

Economist Thomas Sowell, in his critique of the “Vision of the Anointed,” warns of the unintended consequences of such ideological policymaking. For instance, ESG standards often prioritize social and environmental goals over economic efficiency, risking misallocated resources and stifled growth. Similarly, CRT-based workplace initiatives can lead to polarization by framing issues of race and privilege through divisive narratives.

The influence of these policies extends beyond the corporate sphere, permeating education, media, and technology. This cultural reengineering not only imposes centralized control but also risks undermining the individual freedoms and economic dynamism that have defined America for centuries. Warren’s vision is not just about corporate governance—it represents a broader effort to reshape the cultural and economic landscape under progressive orthodoxy, threatening the liberties that underpin American prosperity.

Warren’s “Accountable Capitalism Act”: A Trojan Horse for Big-Government Socialism

Elizabeth Warren’s proposal masquerades as a safeguard against corporate greed but functions as a Trojan horse for big-government socialism. Through measures like federal charters for large corporations, mandated union representation on boards, and centralized bureaucratic oversight, the act effectively places corporate America under the control of progressive ideologues. Additionally, the bill includes a provision to revoke the charters of corporations engaging in repeated and egregious illegal conduct.

Federal Charters and State Control: The bill’s requirement for federal charters redefines corporate purpose by subordinating profit to state-defined social objectives. By embedding progressive priorities like DEI and ESG into governance, this measure centralizes economic control, undermining the autonomy of businesses.

Union Empowerment: The provision to allocate 40% of board seats to employees disproportionately benefits unions, granting them leverage far beyond their actual stake in corporate success. This shift disrupts management and risks decision-making paralysis as competing interests vie for control.

Revoking Charters: Weaponizing Bureaucracy: The provision to revoke corporate charters for repeated misconduct creates a dangerous tool for politically motivated overreach. In the hands of partisan regulators, this power could intimidate or dismantle companies that deviate from the prevailing ideology, fostering a climate of fear and compliance.

Politicized Oversight: By requiring shareholder approval for political spending, Warren introduces a mechanism to stifle dissenting voices. This politicization of corporate governance echoes broader progressive attempts to consolidate control under the guise of accountability.

These measures effectively place corporate America under the control of progressive ideologues, undermining innovation and competitiveness in favor of a government-run economic model. While Warren frames the bill as a response to “corporate greed,” it is, in essence, a Trojan horse for big-government socialism.

Warren’s Claims are False and Lack Context

Elizabeth Warren’s justification for the “Accountable Capitalism Act” rests on flawed premises and misleading interpretations of economic realities. Her assertions about inequality, wage stagnation, and corporate greed disregard critical factors, notably the role of government policies in exacerbating the very issues she decries.

Government-Induced Inequality: Warren blames corporations for widening wealth gaps, but the primary driver is government intervention. Easy monetary policies, massive stimulus packages, and fiscal excess have inflated asset prices, disproportionately benefiting asset holders. During the Harris-Biden administration, the Wilshire 5000 index has more than doubled from approximately $30 trillion to $61 trillion by December 2024, reflecting government-driven wealth concentration. Corporate policies are not the culprit—misguided fiscal and monetary policies are.

Inflation: The Real Wage Killer

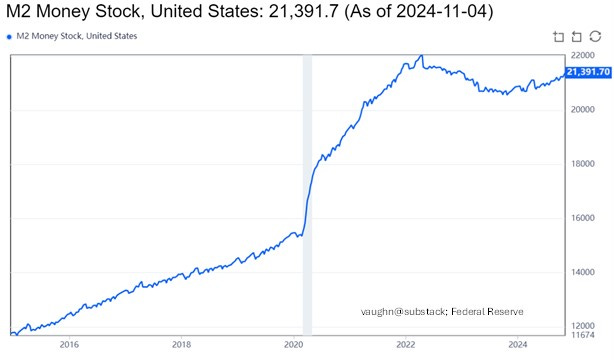

Warren’s focus on corporate greed as the cause of declining real wages overlooks the true culprit: inflation. Over $7 trillion in government spending has driven housing prices to unprecedented highs and eroded the purchasing power of everyday Americans. Moreover, the Federal Reserve injected excessive liquidity into the system by lowering interest rates to below inflation levels and monetizing government debt issued to cover excessive spending in the years following the COVID-19 lockdowns. During this period, the Fed expanded its balance sheet by 42%, or $6.5 trillion, in the aftermath of the government-mandated lockdowns.

This inflationary spiral, driven by massive injections of liquidity and excessive government spending, has disproportionately benefited investors, whose assets—stocks and housing values—have soared to historic levels. Meanwhile, average workers are increasingly priced out of homeownership and struggle financially to put food on the table, cover living expenses, and keep a roof over their heads.

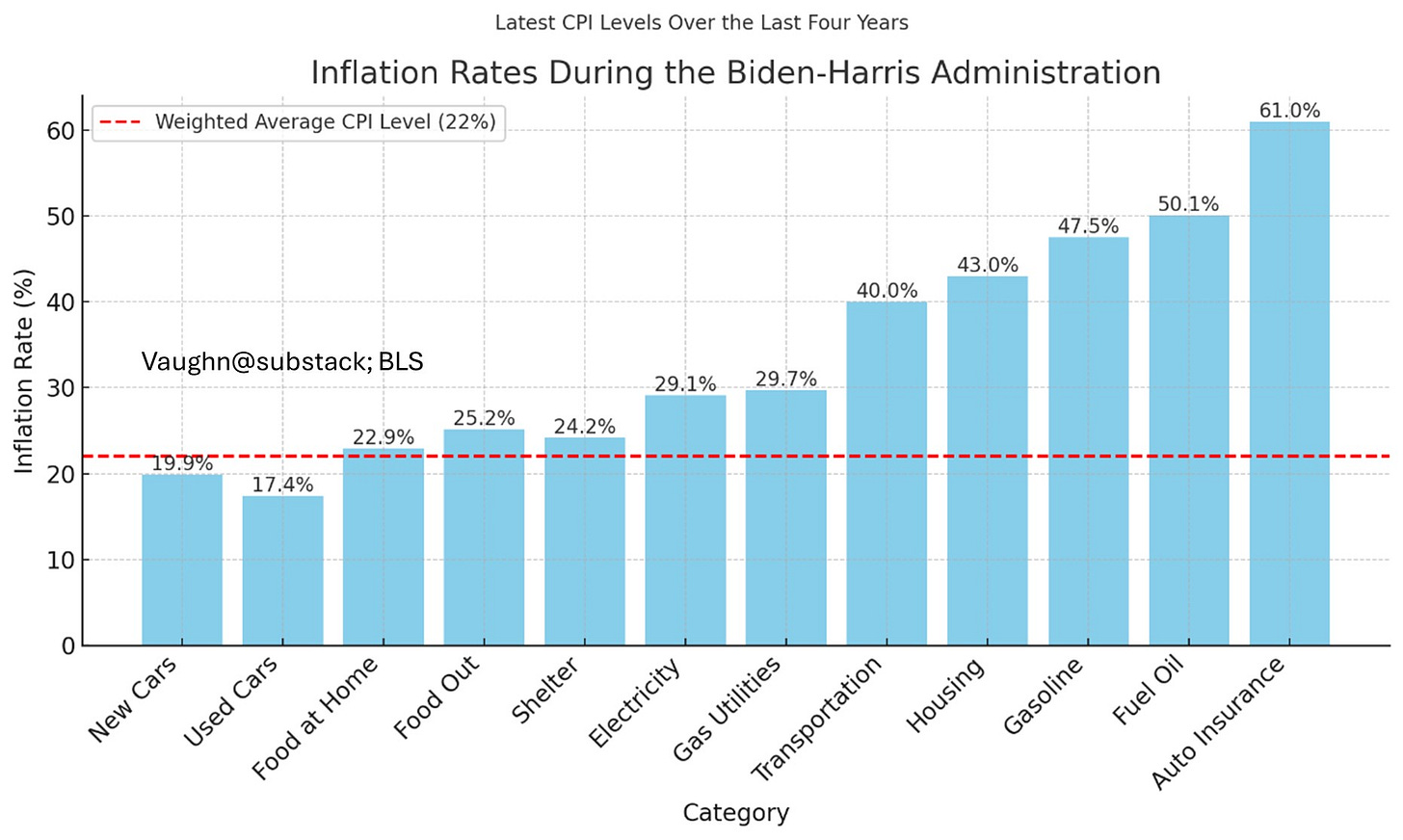

The chart below highlights inflation rates across key categories during the Biden-Harris administration, revealing the profound impact on essential goods, energy costs, and services.

Inflation is not caused by corporate greed; it is the direct result of government policies. Excessive spending, loose monetary policy, and regulatory overreach have created a perfect storm that drives up prices and squeezes household budgets. While average wages have risen by 16.7% during Biden’s four years in office, this translates to an almost 4% decline in real hourly earnings after accounting for inflation.

Moreover, the weighted average inflation rate of 21% does not fully capture the steep increases in essential living costs, such as energy, groceries, and housing—expenses that fall disproportionately on middle- and low-income earners. While Warren points the finger at corporations, it is these misguided policies that continue to erode real wages and undermine economic security for everyday Americans.

Malinvestment and Energy Policy Failures: Warren overlooks the role of government-driven malinvestment in energy policy. Initiatives mandating electric vehicle adoption and costly green technologies have resulted in disproportionate burdens on lower-income households. These policies inflate energy costs domestically while transferring economic benefits abroad to countries that continue to rely on inexpensive fossil fuels. This form of malinvestment distorts markets, erodes purchasing power, and exacerbates inequality—all under the guise of environmental responsibility.

Overlooked Economic Benefits of Corporate Success: Warren’s critique of shareholder returns is myopic, ignoring the broader societal benefits of corporate prosperity. Strong businesses drive job creation, technological advancements, and economic growth that uplift society as a whole. Focusing solely on stock ownership statistics distorts the reality that corporate success fuels widespread improvements in living standards, innovation, and employment opportunities.

Misattributing Wage Stagnation: Blaming corporations for wage stagnation overlooks the destructive effects of government-driven energy policies. The rising cost of energy, caused by misdirected climate initiatives and regulatory overreach, has eroded real wages and increased the cost of living. These policies disproportionately harm the very workers Warren claims to defend, while offering no meaningful reduction in global fossil fuel consumption.

Logical Fallacy: Shareholder Returns

Warren’s claim that maximizing shareholder value benefits only the wealthy reflects a fundamental misunderstanding of economic growth. Robust corporate performance, often spurred by market incentives, drives investment, innovation, and job creation. Government stimulus and deficit spending, not corporate policies, have fueled unsustainable asset bubbles that widen the wealth gap.

Excessive deficit-driven spending and loose monetary policies have inflated stock market valuations. The S&P 500’s price-to-earnings ratio (P/E) currently stands at 27.75, which is 44% above its historical average of 17.9. This distortion is not the result of corporate greed but of misguided fiscal and monetary policies that artificially inflate asset prices.

Excessive government spending—of which deficit spending of over $2 trillion accounts for 7% of GDP—has driven higher corporate earnings, currently just over 10% after tax. Consumers who hold inflated assets are more likely to spend, driven by the wealth effect, which historically translates to about 3 cents of additional spending for every dollar of inflated asset value.

In reality, Warren’s arguments obscure the true sources of inequality and wage stagnation. By shifting blame to corporations, she deflects attention from government mismanagement, malinvestment, and fiscal irresponsibility. These policies, if uncorrected, will lead to mounting debt, slower growth, and reduced opportunities for the very people she claims to champion. Economic freedom and market efficiency—not state control and redistribution—remain the proven paths to prosperity.

Wealth Redistribution and Unsustainable Spending

At the heart of the progressive agenda lies a fundamental objective: wealth redistribution through unsustainable government spending. Cloaked in the rhetoric of “economic justice” and “equity,” Elizabeth Warren’s policies are designed to funnel resources toward politically favored constituencies, consolidating power through dependency. These measures sacrifice economic growth, personal freedom, and national prosperity at the altar of ideological conformity and short-term political gain.

Environmental Justice: A Veneer for Wealth Transfers

Programs masquerading as environmental justice initiatives disproportionately direct taxpayer funds to select groups, institutionalizing race-based redistribution. This isn’t equity—it’s a thinly veiled form of corporate greed, except the corporation is the state, and the profits are political capital. These initiatives fracture society along racial and economic lines, replacing the promise of meritocracy with the poison of dependency. Rather than lifting people through genuine, market-driven opportunities, these policies entrench communities in cycles of government reliance, exchanging dignity for handouts.

Debt-Driven Growth: A Ticking Time Bomb

The United States, with its $36 trillion national debt and deficits running at 7% of GDP annually, mirrors the fiscal irresponsibility seen in Europe. In France, deficit spending of 6% of GDP props up a stagnant economy, leaving future generations to foot the bill. This is not growth; it’s a facade of prosperity built on borrowed time. Just as in Europe, America’s addiction to deficit spending will lead to higher taxes, declining investment, and inevitable economic decay.

Argentina: A Cautionary Tale of Progressive Collapse

No country illustrates the catastrophic effects of misguided “social justice” policies more vividly than Argentina. For decades, Argentina was among the wealthiest nations in the world. Its fertile land, industrious population, and burgeoning industries promised a future of prosperity. Then came the bureaucratic excess, union dominance, and wealth redistribution schemes championed under the banner of “social justice.”

Progressive governments promised equity by expanding welfare, nationalizing industries, and suffocating free enterprise with regulations. The result? Hyperinflation, economic stagnation, and widespread poverty. The government, bloated and inefficient, became a parasite on the nation’s productivity. Corporations were vilified and shackled under the pretense of curbing “corporate greed,” driving investors away and innovation into the ground.

Argentina’s middle class, once the backbone of the nation, was decimated. Dependency replaced self-reliance, and despair replaced ambition. Citizens watched as their savings evaporated, their jobs disappeared, and their country descended into chaos. The false promises of equity and fairness led only to corruption, decay, and ruin.

In response to this economic nightmare, Argentina turned to Javier Milei, a libertarian economist who recognized that salvation lay not in more redistribution, but in free-market principles. Since taking office, Milei has slashed government agencies, cut spending, and confronted inflation head-on. His reforms are restoring stability, encouraging investment, and offering a glimmer of hope. The Argentine people, exhausted by progressive illusions, are beginning to reclaim their economic freedom.

The American Parallel: The Same Path to Decline

Elizabeth Warren’s agenda echoes the policies that brought Argentina to its knees. Her proposals, dressed in the language of fairness and accountability, undermine the engines of prosperity: free enterprise, innovation, and individual initiative. Just as Argentina vilified its entrepreneurs and productive class, Warren targets corporations under the pretext of combatting greed. But it is not corporate greed that drives inequality; it is government-induced malinvestment, inflation, and fiscal recklessness.

In the United States, these policies are manifesting in skyrocketing debt, rising energy costs, and stagnating wages. Environmental mandates and regulatory overreach burden American households while giving economic advantages to foreign nations that continue to burn fossil fuels unabated. This isn’t justice; it’s economic self-sabotage masquerading as moral virtue.

Taxing Capital: The Road to Economic Paralysis

As deficits mount, progressives inevitably turn to taxing capital. But capital is the lifeblood of growth. Higher taxes on investment discourage innovation, drive entrepreneurs overseas, and starve the economy of vitality. Europe has shown that taxing capital, without reducing spending, only delays the collapse. The result is chronic stagnation, job losses, and reduced living standards.

The Destruction of Prosperity

Warren’s vision offers a future where government overreach replaces individual freedom, where redistribution replaces opportunity, and where dependency replaces self-reliance. It is a path well-trodden by nations that have traded prosperity for the illusion of fairness. History is unequivocal: social justice policies that prioritize equity over efficiency lead to decline, stagnation, and despair.

America stands at a precipice. To follow the progressive agenda is to court the same fate as Argentina—a slow slide into economic ruin. The alternative is to reaffirm the principles that built this nation: free markets, limited government, and individual liberty. Only by embracing these values can America preserve its prosperity, innovation, and position as a beacon of opportunity for the world.

Why Now? Warren’s Political Calculations

Elizabeth Warren’s decision to reintroduce the Accountable Capitalism Act is no accident of timing—it is a calculated move to advance her progressive agenda and solidify her influence within the Democratic Party. Though the bill has little chance of passing in a Republican-controlled Congress, its reintroduction serves a broader purpose: bolstering her credentials as a champion of economic justice, energizing key constituencies, and framing the debate on capitalism ahead of upcoming elections.

Warren understands that optics and messaging are as crucial as policy outcomes. By targeting “corporate greed” and promoting union empowerment, she reinforces her image as an advocate for workers and the underprivileged. This resonates with progressive voters, union members, and activists who view her as a bulwark against corporate excess and the free-market policies championed by figures like Donald Trump and Argentina’s Javier Milei.

The bill’s reintroduction also provides an opportunity to vilify the MAGA platform as a threat to equity and justice. By casting her opponents as defenders of unchecked capitalism, Warren positions herself as the moral alternative. This narrative, while misleading, galvanizes Democratic support, particularly among younger voters receptive to economic reform and social equity.

Warren’s timing strategically appeases powerful constituencies within her party. By championing labor rights, union representation, and progressive oversight, she strengthens alliances with organized labor and left-leaning advocacy groups—key pillars for maintaining political clout, fundraising, and grassroots mobilization.

Reintroducing the bill during economic uncertainty amplifies its rhetorical impact. Rising inequality, inflation, and corporate profits provide fertile ground for her critique of capitalism. By blaming the free market for these woes, she deflects attention from government-induced malinvestment, regulatory overreach, and fiscal mismanagement. This sleight of hand lets her capitalize on economic frustrations while promoting policies that deepen state control.

Ultimately, Warren’s strategy is less about passing legislation and more about shaping the ideological battlefield. By prioritizing equity over efficiency and state oversight over market freedom, she challenges the limited-government principles that underpin American prosperity. Her proposal serves as a rallying cry for progressives and signals to moderates that the Democratic Party’s future lies in expansive government intervention.

Warren’s political calculations are clear: she aims to position herself as the vanguard of a progressive economic revolution. The Accountable Capitalism Act lays the groundwork for a broader struggle between centralized control and free-market liberty. The stakes are not just economic—they are cultural and existential. If her vision prevails, economic freedom and innovation could give way to bureaucratic dominance and dependency.

In the end, Warren’s move is a strategic signal to her base, a warning to her opponents, and a blueprint for transformation. Whether or not the bill passes, her goals are clear: to reshape the economy, redefine capitalism, and cement the progressive agenda as the Democratic Party’s guiding philosophy.

Conclusion: The Stakes of America’s Economic Future

Elizabeth Warren’s Accountable Capitalism Act is not about corporate accountability; it is about consolidating control and power under the guise of justice. By shifting authority from private enterprises to unions and bureaucrats, her proposal undermines the free-market principles that have fueled American prosperity for centuries.

Milton Friedman’s timeless assertion that the social responsibility of business is to increase profits underscores a simple truth: market-driven efficiency promotes innovation, economic growth, and higher living standards for all. In contrast, Warren’s vision sacrifices this efficiency for the illusion of equity, replacing entrepreneurial dynamism with bureaucratic paralysis.

History has provided ample warnings. From Argentina’s collapse into hyperinflation and poverty under progressive policies to Europe’s stagnation under crushing regulation and debt, the pattern is clear: unchecked government overreach leads to economic decay and diminished freedoms. The biggest economies in Europe—England, France, and Germany—have been living on borrowed time due to decades of overspending, stifling regulations, and union-backed policies. These choices have led to fractured governments unable to control ballooning budgets.

Adding to this decline are the misguided climate policies of both Europe and the United States. While these measures have reduced CO₂ emissions domestically, they have done little to reduce emissions globally. In fact, worldwide emissions continue to rise significantly as nations like China and India expand their middle classes and energy demands. By crippling their own energy industries, Western governments have undermined economic growth without addressing the core issue, as global emissions are driven by developing countries that remain reliant on fossil fuels.

America now stands at a similar crossroads. The choice is stark: embrace the principles that built the world’s most vibrant economy—free markets, limited government, and individual liberty—or yield to the seductive but destructive promises of state control and wealth redistribution. Warren’s agenda, if implemented, risks turning America into yet another cautionary tale of decline, where innovation is stifled, ambition is punished, and dependency becomes the norm.

Beware of progressives bearing “free money.” New York Governor Kathy Hochul’s proposal to issue $500 “inflation relief” checks to 8.6 million New Yorkers—at a cost of $3 billion—demonstrates the surreal logic of progressive economics. In a misguided attempt to ease the burden of inflation, caused by excessive government spending, she proposes to spend even more. This cycle of borrowing and spending fuels the very inflation it claims to combat, ultimately worsening the problem and increasing dependency on government handouts.

The American people must reject this vision of centralized control and endless spending. The path to prosperity lies not in false promises of equity through redistribution but in the proven principles of freedom, competition, and opportunity. By defending these values, we can safeguard our entrepreneurial spirit, preserve economic freedom, and maintain our position as a beacon of innovation and opportunity for the world.

The stakes are nothing less than the future of America’s economic soul. The choice is ours—and history will judge us accordingly.

Well written and interesting! From the perspective of both myself and the specter of the United States' Old Republic, both the points of view expressed here are deeply in error. The Old Republic rejects both Warren’s vision and the current system because they are, in different ways, antithetical to its foundational principles. The Neoliberal Era, far from embodying free markets and competition, has brought centralized control and economic central planning disguised as deregulation. By dismantling local financial autonomy, removing capital flow inhibitors, and enabling corporate consolidation, installing near complete regulatory harmonization, this system has artificially constrained competition while concentrating power in the hands of large corporations, financial elites, and a technocratic bureaucracy. This centralization of decision-making, under the guise of “market efficiency”, is precisely why the Old Republic would have thoroughly rejected Milton Friedman. His vision, centered on profit maximization as the sole responsibility of business, accelerates monopolistic structures and erodes the decentralization and economic diffusion that generate true competition, dynamic local, regional, and national economies, greatly shrinks scientific and engineering research and development ecosystems, and diminishes both competition and innovation.

Warren’s proposal, while framed as corporate accountability, also consolidates control, albeit via a different path, through unions and federal bureaucracy, further centralizing authority rather than restoring economic balance through regional and local mechanisms. The Old Republic understood that government intervention could be necessary, but only in ways that diffused power, encouraged variability, and prevented elite dominance. Warren’s approach, like the system we have now, imposes top-down solutions that stifle innovation, limit regional autonomy, and replace self-governing communities with centralized oversight. Both visions ignore that prosperity stems from decentralization, local accountability, and competition rooted in dispersed decision-making: principles the Old Republic championed and which enabled economic and social dynamism for over a century.

Thus, the choice presented in this post, between Milton Friedman’s flawed centralization and Warren’s bureaucratic overreach, misses the alternative that defined America’s earlier success: a system of decentralized governance, regional autonomy, and truly competitive markets free from concentrated power, whether corporate or bureaucratic. The stakes, as the post rightly states, are about the soul of America’s economy, but both options represent forms of centralization that the Old Republic would oppose. The true path forward lies in rediscovering the balance, diffusion, and local variability that once defined the nation’s economic and political vitality.