The Economic Illiteracy of Harris and the Radical Left are Destroying the American Dream

The progressive agenda represents the worst type of government rule, as it would effectively expand the administrative state’s size and power, leading to a financial crisis and less freedom.

Introduction

Misguided policies from the Biden-Harris administration and the progressive wing of the Democratic Party exacerbate the country’s current economic challenges. Anti-capitalist measures, a focus on reducing fossil fuel reliance, and massive government spending have contributed to historic inflation levels, skyrocketing national debt, and job market shifts favoring non-citizens over American-born workers.

Inflation is not a result of corporate greed but rather a direct consequence of the government’s policies and the war on fossil fuels. The decision to spend, borrow, and print trillions of dollars has created significant inflationary pressures. The $7 trillion in government spending, increased regulations, and an irrational energy policy have increased food and energy costs.

Regulatory compliance costs per family have risen by approximately $5,000 since the Biden-Harris administration took office. In contrast, these costs decreased by $2,000 during the Trump administration.

The notion that corporations suddenly became greedy in 2021, after decades of stable behavior, is absurd. Instead, inflation is a byproduct of the policies implemented by the Biden-Harris administration and their party during their time in office.

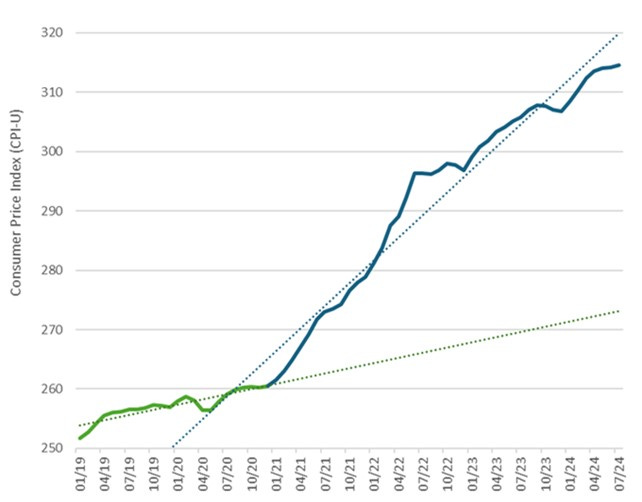

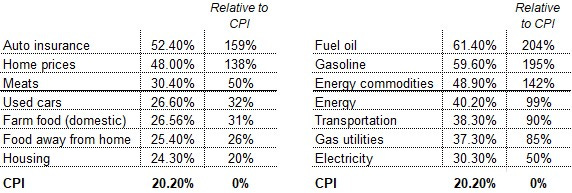

As measured by the CPI, consumer prices remain unprecedented, with inflation rising at about 3%. Notably, the CPI experienced a significant surge after January 2021, with overall inflation exceeding 20% since Biden’s election.

The average American family’s most common expenses have increased by 30% over the last four years. The costs of vehicles, maintenance, repair, and insurance have surged significantly, making driving prohibitively expensive for many. Energy costs are double the Consumer Price Index (CPI), and gasoline prices are four times higher than when Trump left office. Soaring inflation and higher prices are what an anti-fossil fuel agenda produces.

Since President Biden took office, housing costs have risen by over 24%, a figure that does not account for the price of capital, such as interest rates. Homeownership costs have more than doubled when these are factored in, with monthly mortgage payments on a median-priced home increasing by 112%.

Food costs have reached unprecedented levels – approximately one-fourth of renters have had to forgo meals in the past year to keep up with their bills. This signifies a cost-of-living crisis. Retirees on a fixed income, especially older individuals, struggle to make ends meet. Many accrue credit card debt to cover daily necessities, with interest rates surpassing 20%.

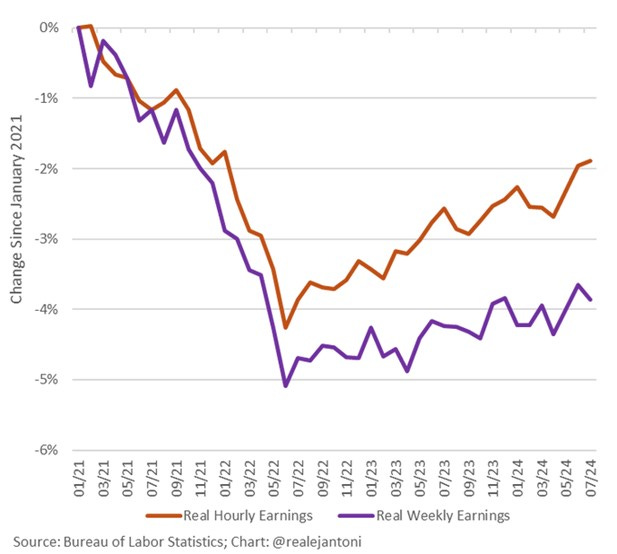

Inflation outpacing earnings growth and increased borrowing costs due to higher debt balances and interest rates have reduced the average American family’s annual income by approximately $7,800 since January 2021, when President Biden assumed office. Hourly pay, adjusted for inflation, has declined by nearly 2% since January 2021. However, due to a decrease in average hours worked, weekly paychecks have fallen by approximately 4% in real terms. The gap between nominal and real hourly wages represents an average inflation tax of about $5.70. Consequently, in real terms, an average salary of $35 equates to only $29 in purchasing power.

High Prices are the Result of Government Spending and Federal Reserve Policies

After the 2020 pandemic lockdown, supply chain strains, increased demand for goods, tight labor markets, and rising commodity prices led to a rapid rise in inflation, as noted by Jerome Powell last week. However, he omitted the massive increase in the money supply by the Federal Reserve and the national debt. Inflation was indeed driven by demand, but that demand was fueled by excessive government stimulus spending, which expanded debt and below-inflation interest rates through a significant increase in the monetary base.

Government actions, including the mandated lockdown, resulted in 40-year highs in inflation, which have yet to decrease in terms of inflation levels. Powell, like the Biden administration, attributes the problem primarily to supply chain strains, which initially spiked inflation. However, if supply chain issues were the sole cause, inflation should have subsided once those pressures normalized. Although the inflation rate has decelerated, prices are still increasing at a rate of 2.9% according to the July report.

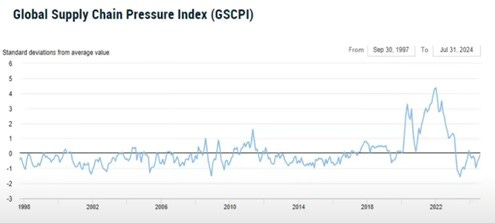

The Global Supply Chain Pressure Index (GSCPI) is a tool for assessing supply chain conditions on a global scale. It integrates transportation cost data and manufacturing indicators to gauge the intensity of supply chain disruptions. These disruptions were more pronounced at the start of the COVID-19 pandemic. The GSCPI considers factors like global transportation costs (measured using indices like the Baltic Dry Index and airfreight cost indices) and supply chain-related components from Purchasing Managers’ Index (PMI) surveys across interconnected economies.

As highlighted in the chart, supply chain pressures eased significantly over a year and a half ago. The reason prices (CPI level) are 22% higher is due to a nearly 60% increase in the national debt and a 42% rise in the money supply (M2). In short, high prices are the result of government spending and an increased money supply. Note the correlation between the money supply and inflation (CPI).

M2 consists of M1 plus: (1) savings deposits (which include money market deposit accounts, or MMDAs); (2) small-denomination time deposits (time deposits in amounts of less than $100,000); and (3) balances in retail money market mutual funds (MMMFs).

Harris Wants Ban on Food Price Gouging

Vice President Kamala Harris advocates a federal food and grocery price gouging ban. Prices are determined by supply and demand, and such a move attempts to blame the industry for overall inflation. Harris seeks more authority for the Federal Trade Commission and states to investigate companies for antitrust practices.

Any attempt to ban “price gouging” would essentially amount to price controls. Policies that give the government the power to decide which price increases are “fair” or “unfair” effectively create a price control system. Whether labeled “anti-gouging,” “fair pricing,” or “consumer protection,” the effect is the same: when bureaucrats, not markets, determine acceptable prices, it results in price control.

America has attempted price controls before, under presidents Nixon, Ford, and Carter, as have dictators like Josef Stalin, Fidel Castro, and Nicolás Maduro. History shows that price controls don’t work; they lead to shortages, rationing, higher inflation, and increased poverty. Trump aptly calls it “the Maduro plan,” likening it to policies from Venezuela and the Soviet Union.

Americans are experiencing inflation across nearly every aspect of their lives—rent, gas, automobiles, and insurance—not just in groceries and meat. A federal ban on price gouging does not address the natural causes of inflation.

Food and meat prices are determined by supply and demand. The livestock and poultry industries have faced challenges such as avian influenza, cattle shortage, higher energy costs, and a tight labor market. Prices for livestock producers are heavily influenced by supply and demand dynamics. Cattle prices remain at record levels due to the lowest cattle inventory in decades. Major meat companies have reported losses during the Biden-Harris administration, with some closing facilities and laying off workers. For instance, Tyson Foods has closed several pork and poultry processing facilities over the past two years.

Farm food produced domestically has increased by almost 27% since the start of the Biden administration. Rising energy prices significantly impact agriculture by increasing production costs in several ways:

Operational Costs: Higher fuel prices raise running farm machinery and equipment costs, reducing farmers’ margins unless they can pass these costs on to consumers.

Irrigation Expenses: In regions reliant on irrigation, increased energy prices make water pumping more expensive, affecting the viability of certain crops.

Fertilizers and Pesticides: These energy-intensive inputs become costlier as energy prices rise, impacting farmers’ budgets.

Transportation and Logistics: Fuel price hikes increase the cost of transporting goods, squeezing the supply chain from input delivery to product distribution.

Processing and Storage: Energy-intensive post-harvest processes become more expensive, potentially leading to higher food waste if farmers forgo these processes.

These increased costs ripple through the agricultural value chain, affecting farmers and consumers. Higher production costs can also lead to reduced planting or investment in efficiency measures, negatively impacting food security and sustainability.

Rising energy expenses are fundamentally driving the surge in food prices. Higher costs typically result in lower production and supply, a market function that progressives and Harris do not understand or agree with, as it undermines their big government spending agenda.

The USDA and the Department of Justice began investigating cattle markets during the pandemic, but no conclusion was reached, and no report was released. Even the Federal Reserve has concluded that price controls do not reduce inflation.

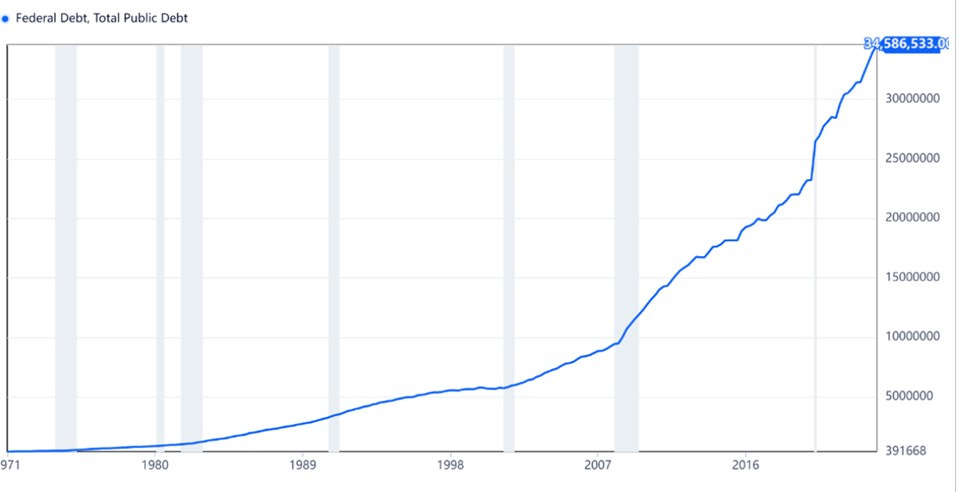

Public Debt Soared During Obama and Biden’s Time in Office

The evidence does not support the claim that tax cuts during Trump’s presidency were the primary cause of the debt increase. According to government statistics from the Federal Reserve Bank of St. Louis, the national debt increased by $3.377 trillion (16%) during Trump’s time in office before the pandemic lockdown year of 2020. In 2020, with bipartisan support, the debt increased by $4.9 trillion (21%). During Biden’s time in office, the debt has increased by $7.25 trillion (24.4%).

Under Obama, the debt increased by $8.72 trillion (78.4%) over eight years. During the Obama and Biden administrations, the debt increased by nearly $16 trillion, almost five times more than the $3.38 trillion increase under Trump. Democrats have held power for 11.5 years, or 74% of the time, over the last 15.5 years, contributing to the vast majority of the current $35 trillion in national debt.

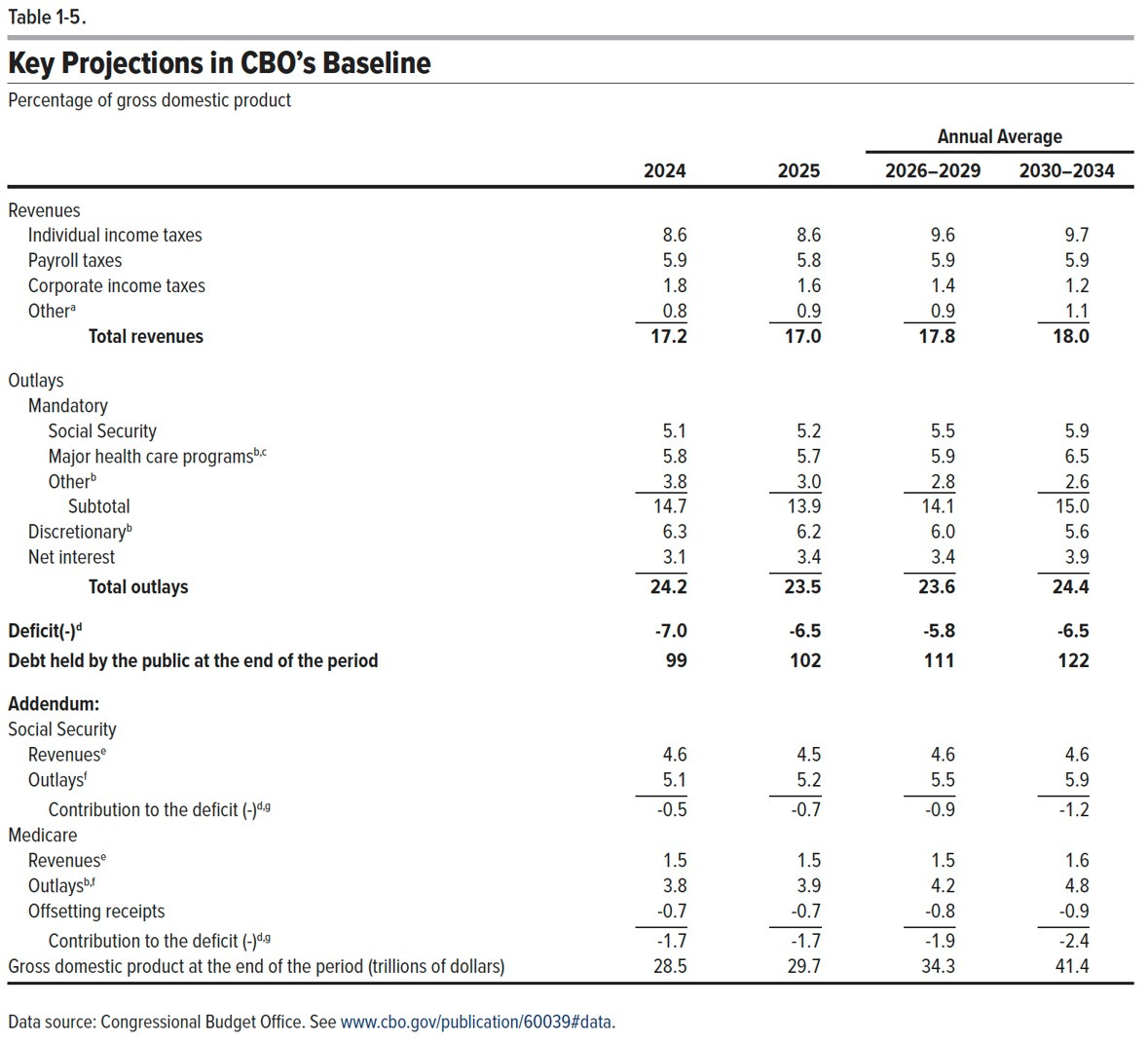

The latest report from the Congressional Budget Office (CBO), dated June 2024, projects that average annual deficit spending will be $2.4 trillion over the coming decade, through 2034. It also forecasts that public debt will nearly double, reaching $50.67 trillion, up from $26.24 trillion in 2023. Deficits will average 6.3% of GDP over the next 10 years.

Net interest on the debt is projected to soar to $1.71 trillion in 2034, up from $658 billion in 2023. Interest costs have soared from $482 billion in 2021 to $1.1 trillion as of April 2024, now representing 3.8% of nominal GDP. As a percentage of total revenue, net interest expense is expected to increase from 15% in 2023 to 23% in 2034, representing a 53.33% increase.

U.S. government spending as a percentage of GDP has increased by 59% over the past five years, rising from 20% in the 2000s to 27% in the 2020s, with expectations to average 24% in the next decade. Meanwhile, the Total Debt relative to GDP is anticipated to grow by 26% in the coming 11 years, from 97.3% in 2023 to 122.4% in 2034.

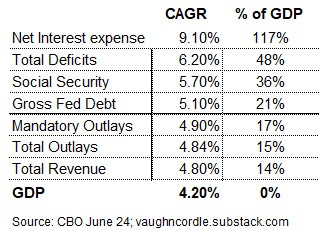

The problem lies in spending (outlays), deficits, debt, and the interest on that debt, all growing faster than GDP and revenue. For example, the net interest expense is projected to exceed GDP growth by more than double, at a rate of 117%, when averaged with the compounded annual growth rate (CAGR) from 2023 to 2034, according to projections by the Congressional Budget Office (CBO).

Projections from the CBO typically underrepresent actual outcomes and should be viewed with skepticism. They do not account for an economic slowdown or recession, and their GDP growth estimates are much higher than those of the Federal Reserve and private sector forecasts. Consequently, revenue growth is likely to be lower than projected, while outlays may be higher, which implies debt and deficit spending will be higher.

Kamala Harris wants to spend even more, attempting to buy votes with a long list of taxpayer-funded handouts and subsidies.

Federal Debt, Total Public Debt: $35 trillion (As of Aug 2024)

The Weak Job Market and the Growth of Non-Citizen Employment

Recently, it was revealed that 818,000 fewer jobs were created over the 12 months ending in March 2024 than previously reported by the Bureau of Labor Statistics (BLS), with total payroll levels declining by 0.5%. This significant downward revision is the largest since 2009. Substantial issues with the Labor Department’s statistical models and methodologies remain unresolved.

The critical question is not whether the government is manipulating data but why these problems, evident since the spring of 2022, have not been corrected. When will the Labor Department be held accountable, and when will they explain to Congress and the American people what is happening and why these errors remain unaddressed?

Left-leaning politicians promised an economic panacea if the government could spend trillions of dollars we didn’t have. The bill is coming due to years of wasteful spending and steep prices.

Job Growth Trends

Over the past year (August 2023 - August 2024), foreign workers born outside the U.S. have gained 1.27 million jobs, while jobs for U.S.-born workers have decreased by 1.2 million. The Bureau of Labor Statistics (BLS) acknowledges that this number includes an unknown number of illegal aliens.

There are fewer American-born workers today than before the pandemic, and all net job growth over the last four years has been attributed to foreign-born and government workers.

Professional & Business Services - 358k

Leisure & Hospitality -150K

Manufacturing – 115k

Trade, Transportation & Utilities – 104k

Retail Trade – 129k

Private Education & Health Services +87k

Transportation & Warehousing +56.4k

Economic Red Flags

New orders across various sectors of the economy are plummeting. Initially, this wasn’t a significant concern because orders spiked when the economy reopened after the COVID lockdowns. However, they have continued to decline.

As prices rise due to runaway spending, consumers run out of savings. Pandemic-era savings are depleted, and pre-pandemic savings are exhausted. Only the top 10% still have savings as a group.

Americans have gone deeply into debt. Rising interest rates due to excessive government spending lead to massive debt loads and increased costs to service that debt. Families spend over $300 billion annually on credit card interest without reducing the principal. This situation is unprecedented.

The government has over $35 trillion in debt, rapidly approaching $36 trillion. Servicing this debt costs $1.2 trillion annually, resulting in increased interest payments. In July, the government spent 33% more on servicing the federal debt than on all military spending, highlighting the debt as a national security crisis.

The Harris-Walz proposed policies will accelerate the debt crisis, creating an opportunity for power consolidation. Support from 10-16 million illegal immigrants could give them the edge to remain in power. Undocumented immigrants, drawn by open border policies and social services, are allies in their political fight for influence and power.

Economic Consequences

Consumers are hitting a financial wall, finding it increasingly difficult to obtain additional credit to sustain spending. Economic expansions fueled by credit binges eventually end, and the consequences will be painful when they do.

The markets may not seem concerned about the $35 trillion in debt, but adjusting these figures for inflation is crucial. Even using an official metric like the Consumer Price Index (CPI), which has limitations, over two-thirds of the gains in the Dow over the past 3.5 years can be attributed to inflation. This suggests that the increase in market values is not due to a rise in companies’ worth but because the dollar used for evaluation is significantly less. This perspective underscores the impact of inflation on perceived market gains and suggests that traditional metrics do not fully capture the underlying economic realities.

Kamala Harris and the Democrats are trying to distance her from the Biden-Harris administration’s policies. However, Harris played a crucial role as the deciding vote and tiebreaker for significant legislation such as the Inflation Reduction Act, the Fiscal Responsibility Act, and other progressive policies, including green energy tax credits, contributing to $7 trillion in spending.

The question arises: how do we address inflation after such extensive and reckless spending? There seems to be little discussion about the impact of this spending. This is the elephant in the room.

Harris’s plans include new government spending ranging from $1.7 to $2 trillion, alongside $5 trillion in new taxes. This is the Harris-Walz economic plan, which would significantly increase debt and taxes.

Harris’s Approach is Counterproductive

Harris’s approach is akin to a thief investigating their own crime. She suggests that if given four more years in Washington, she will address the problems she contributed to at the start of her current term. This is illogical, especially since her promises involve doubling down on the same failed policies. The saying goes that arsonists often return to watch the fire they started; Harris promises to go one step further by bringing a fresh supply of kerosene and matches.

Her plans to increase spending, taxes, and regulation are counterproductive and reflect a profound misunderstanding of how markets and economics work in practice. This agenda to expand government regulation and control will exacerbate existing problems.

Harris’ progressive agenda represents the worst type of government overreach, as it would effectively expand the size and power of the administrative state to the disadvantage of the American people and their freedom.

Economic and Policy Concerns

The Left is ideologically committed to raising taxes, even as a recession looms. Despite the administration’s claims of job growth, manufacturing has been in a recession. The unemployment rate is increasing, and the Harris administration must justify higher taxes, government spending, regulations, and control.

Raising taxes as a recession approaches is problematic. Job numbers for August and September are likely to decline. Anticipated tax rate increases under a Harris administration suggest businesses may reduce spending in anticipation of tax hikes and slower economic growth.

Kamala Harris seeks to continue reckless spending, aiming to gain support through a long list of taxpayer-funded handouts and subsidies.

Harris-Walz tax policies include the following:

Small business tax rate hike to 39.6%

28% Corporate Tax

44.6% Capital Gains Tax

25% Tax on unrealized gains

Price Controls

No tax on Tips

Up to $6k child tax credit

Final Thoughts

The fiscal and regulatory policies supported by Kamala Harris and her far-left party reflect a profound misunderstanding of fundamental economic principles, such as the role of markets and the private sector as the most effective allocators of finite taxpayer resources.

Raising taxes amid signs of an impending recession is alarming. It would stifle growth and burden businesses, reducing investment and job creation. Additionally, any increase in government spending would expand an already bloated welfare state.

Including the social costs associated with 11-16 million illegal immigrants will further escalate government spending and debt to unsustainable levels, resulting in fewer job opportunities and lower wages for Americans who can least afford it.

A Harris-Walz administration is not moderate, as they are falsely portrayed; their policies reflect a progressive and far-left agenda. Their approach represents significant government overreach and intervention, expanding the size and power of the government to the detriment of the private sector and the American people. In short, their policies reflect a socialist agenda that has undermined the American Dream and weakened our country through unsustainable debt and deficit spending.

Harris and her party have created a debt crisis through unsustainable social and deficit spending. This will eventually lead to a crisis in Medicaid, Medicare, Social Security, and the welfare system.

By exploiting the gap between law and practice, the government and its taxpayer-funded agencies and charities provide financial, housing, education, and healthcare aid to illegal immigrants. They inform immigrants of their rights to assistance, encouraging them to apply for benefits. Combined with the looming debt crisis, this could eventually overwhelm an already strained bureaucracy and government budgets, potentially leading to collapse. At that point, the government might declare an emergency and replace the welfare system with a guaranteed annual income, fulfilling the Left’s long-sought-after agenda to transform America.

If Harris and the Democrats gain control of all levers of power, reckless deficit spending will persist, a necessity to maintain their grasp. The nation will eventually face a financial crisis, creating an opportunity for power consolidation. The executive might declare an emergency, enabling more borrowing and spending for “those in need.” At that juncture, America’s republic and democracy could transition toward a failed authoritarian welfare state.

Capital flight may become the only option for those with financial means to escape government wealth confiscation. Everyone else, except the political elite and their donor class, would be left to suffer the consequences of this destructive progressive experiment.

The most significant risk to our republic and democracy can be reflected in the words attributed to historian Alexander Tytler: “A democracy is always temporary; it simply cannot exist as a permanent form of government. A democracy will continue to exist until voters discover they can vote for generous gifts from the public treasury. From that moment on, the majority always votes for the candidates who promise the most benefits from the public treasury, with the result that every democracy will finally collapse due to loose fiscal policy, which is always followed by a dictatorship.”