Trump’s July 4th Gift to the Nation

Trump’s America First Agenda Will Prove the Experts Wrong Again.

Trump’s new economic agenda shatters the broken forecasts of Washington’s static modelers—reviving growth, slashing deficits, and proving once again that Trump’s First America Agenda outperforms the experts at every turn. This report exposes why they’re consistently wrong—and why they’ll get it wrong again.

Trump’s Agenda vs. the Forecasting Cartel

President Donald Trump’s 2025 "One Big Beautiful Bill Agenda" (OBBBA) is not just another economic package—it’s a targeted strike against stagnation, offshoring, and fiscal decay. Built on supply-side principles, OBBBA reignites growth through tax cuts, strategic tariffs, deregulation, energy expansion, and business investment incentives.

Yet critics—anchored to the outdated models of the Congressional Budget Office (CBO) and echoed by CRFB, ProPublica, and Bloomberg—reflexively dismiss it. They did the same with Trump’s 2017 Tax Cuts and Jobs Act (TCJA), projecting dismal growth and soaring deficits. They were wrong then, and they’re wrong again.

This essay lays out why. It documents how the CBO’s static assumptions failed to predict the job gains, wage growth, and revenue outperformance of Trump’s first term—and how they’re once again underestimating the compounding power of dynamic reforms. Tariffs alone are now projected to generate $300–$400 billion annually, nearly matching my original $340 billion midpoint estimate in Trump’s Tariff Kickoff: Nine Pillars for America’s Lasting Comeback (April 10, 2025).

Critics cling to a 1.8% GDP growth forecast while ignoring the real-world impacts of pro-growth policy: surging private investment, rising tax receipts, falling inflation, and restored business confidence. The models are broken. The evidence isn’t.

The CBO Was Wrong Before—and It's Wrong Again

When the TCJA passed in December 2017, the CBO-driven consensus projections claimed it would widen the deficit by $1.9 trillion, cap GDP growth at 1.6%, and have little effect on employment. The actual results? GDP averaged 2.6% from 2017 to 2019—63% higher than CBO’s forecast. Unemployment fell to a 50-year low of 3.5%. Real wage growth for blue-collar workers outpaced inflation, and the bottom half of income earners saw meaningful gains in living standards. Federal revenues from 2018 to 2022 exceeded projections by $1.025 trillion.

In 2021, ProPublica blamed the $984 billion deficit in 2019 on the TCJA, ignoring that tax revenues exceeded the CBO’s post-TCJA projections. The real driver wasn’t tax relief—it was pre-committed spending, much of it stemming from Obama-era programs like Obamacare, enacted when Democrats controlled both Congress and the White House. This is how false projections are laundered into media “facts,” embedding misinformation into public perception.

Now they’re doing it again with OBBBA, claiming a $4.1 trillion deficit impact while ignoring dynamic effects.

Trump’s Big Beautiful Bill: Growth Up, Deficits Down, Models Shattered

OBBBA extends and builds upon TCJA with permanent tax relief, targeted deregulation, elimination of wasteful subsidies, and strategic tariffs. The CBO’s outdated 1.8% GDP growth assumption grossly underestimates the output and revenue impact.

OMB and Heritage forecast 2.5% to 3% growth under OBBBA. A 1% increase in GDP over 10 years generates roughly $600 billion in revenue. At 2.5% to 3% GDP growth, dynamic scoring adds $600 billion to $1 trillion in new revenue—undermining the CBO’s overstated cost projection and exposing how deeply they underestimate supply-side outcomes.

Trump’s policy structure delivers economic feedback loops that static scoring ignores. When investment and output rise, deficits shrink relative to GDP. That’s what happened from 2017–2019. It will happen again.

The Growth Engine: Tax Cuts, Investment, Tariffs, Deregulation

A. Tax Cuts and Business Incentives

OBBBA makes TCJA permanent, blocking a $4 trillion tax hike. Standard deductions rise, the 23% small business deduction is locked in, and 100% bonus depreciation is reinstated. These reforms alone are projected to create 1 million jobs annually and lift GDP by 1.0% to 1.2%. Small businesses—especially pass-throughs and S-Corps, which account for 40% of U.S. jobs—can now plan, hire, and expand without fear of rising tax rates.

B. Corporate Investment Momentum

$6–$6.5 trillion in private investment pledges are already underway. Hyundai’s $21 billion commitment alone supports production of 1.2 million vehicles annually. IBM, TSMC, and a wave of foreign capital—spurred by Trump’s tax and production incentives—are moving to the U.S. The Council of Economic Advisers projects these investments will generate $1–$2 trillion in tax revenue and create up to 600,000 new manufacturing jobs.

C. Tariffs as Strategic Revenue and Leverage

Trump’s 10% global and 25% auto tariffs are projected to generate $300–$400 billion annually. Critics insisted these tariffs would ignite inflation—especially in March through June 2025 as they took effect. They were wrong. CPI, PCE, and super-core CPI all declined during those months.

The inflation panic was manufactured. Even Federal Reserve Chair Jerome Powell confirmed that tariffs produce a one-time price-level adjustment—not sustained inflation. And in this case, even that adjustment never materialized. Some targeted industries will still experience modest price shifts later this year, particularly those reliant on cheap foreign inputs, but nowhere near the levels forecasted by opponents.

Meanwhile, production is shifting back to U.S. soil, manufacturing GDP is climbing, and foreign exporters are absorbing the cost. Tariffs aren’t a tax on Americans—they’re a strategic lever to rebuild domestic industry and fund fiscal repair. The inflation narrative collapsed under the weight of reality.

D. Energy and Deregulation

Repealing green subsidies, expanding oil and gas leasing, and overhauling permitting will drive down energy costs and boost productivity—reestablishing America’s competitive edge in energy-intensive industries. Together, these reforms are projected to lift GDP by 0.5% and accelerate industrial output.

The bill also reinstates 100% bonus depreciation for equipment and research, adding another 1.0% to GDP. Small businesses—particularly pass-throughs and S-Corps, which account for 40% of U.S. jobs—can now plan, hire, and grow without the looming threat of higher tax rates or regulatory uncertainty.

Restoring Fiscal Balance Through Smart Cuts

Critics ignore the spending cuts embedded in OBBBA. Eliminating EV subsidies saves $200–$250 billion. A $250 annual registration fee for EVs adds another $75–$125 billion. Repealing green tax credits saves $600–$700 billion more. These aren’t token offsets—they’re structural reforms that restore fiscal sanity and market discipline.

Combined with tariff revenue, growth-fueled tax receipts, and regulatory savings, the plan trims the CBO’s overstated $22 trillion cumulative deficit forecast (2025–2034) by $5.8–$6.8 trillion—a 26%–31% reduction. Gross federal debt drops from $59.2–$60 trillion (135%–137% of GDP) to $52.4–$54.2 trillion (119%–123% of GDP), a 10%–12% decline.

This reduction cuts annual interest costs by $205–$312 billion by 2035, saving $1–$1.25 trillion over the decade. Ending artificial price supports realigns incentives, eliminates government-driven malinvestment, and fuels private-sector innovation. This isn’t speculative—it’s arithmetic. Static models ignore feedback effects. Dynamic scoring makes them visible.

The Critics Collapse Under Their Own Models

The CBO, CRFB, and their media allies badly underestimated the economic gains from TCJA—then buried the evidence. Now they’re recycling the same discredited models to attack OBBBA. MSNBC, CNN, PBS, NPR, CBS, ABC, Bloomberg, and ProPublica repeat their projections without scrutiny—let alone understanding—turning flawed assumptions into manufactured “truths.”

They warn of theoretical tariff “costs” while ignoring the $10,000–$13,300 in real household gains from wage growth and tax relief. They cling to obsolete models that assume every tariff dollar is passed through to consumers—despite clear evidence that inflation has fallen, not risen, since tariffs took effect. They dismiss $6.5 trillion in investment commitments, ignore labor market strength, and write off revenue from reshored production.

AI search results mirror the same flawed logic—amplifying static assumptions and outdated projections across headlines, feeds, and posts. That’s why the same talking points echo endlessly across social media and the press. Garbage in, garbage out.

And they wonder why public trust is collapsing.

Trump’s Agenda Delivers—And the Data Confirms It

Inflation is falling. Growth is accelerating. Markets are setting new records. Over the next decade, deficits are projected to shrink, interest costs will decline, and gross federal debt will fall well below current CBO projections. Critics who trusted static models were wrong about Trump’s first term—and they’re wrong again.

Trump’s First America Agenda succeeds by unleashing what static models can’t capture: human ambition, powerful investment incentives, and productivity gains. This isn’t a forecast—it’s unfolding in real time. And it’s only the beginning.

According to FRED and BEA, the average deficit during Trump’s first three years (2017–2019) was 3.9% of GDP—well below the CBO’s projected 4.5% and far lower than the 7.5% average under Biden-Harris (2021–2024). Cumulative inflation under Trump was 5.8%—less than 2% annually—while under Biden it soared to 21%, more than 3.6 times higher, eroding real wages and household purchasing power. Excluding the COVID-disrupted 2020, Trump’s policies kept both deficits and inflation lean, while Biden’s unchecked spending pushed gross federal debt-to-GDP from 104.8% to 128.0% by 2024.

These aren’t rounding errors—they’re model failures, exposing the flaws in CBO’s static assumptions and the incompetence of Biden’s progressive economic handlers.

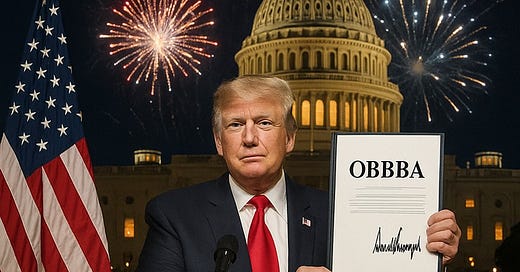

AI Image: July 4, 2025 – President Donald J. Trump delivers America’s birthday gift: the signing of the One Big Beautiful Bill Agenda (OBBBA), a sweeping economic reform plan built on tax cuts, tariffs, deregulation, and dynamic growth. A second revolution—this time for prosperity.

Appendix A: Key Provisions of the OBBBA

Permanent Extension of the 2017 Tax Cuts and Jobs Act (TCJA):

Makes individual income tax cuts permanent, avoiding a $4 trillion tax hike after 2025.

Increases standard deductions: $1,000 (individual), $1,500 (head of household), $2,000 (married joint) through 2028.

Raises SALT deduction cap to $40,000 for earners under $500,000 (reverts after 5 years).

Raises estate tax exemption to $15 million (inflation-adjusted).

New Targeted Tax Relief:

Eliminates taxes on tips (Senate version caps relief at $150,000/$300,000 income).

Eliminates taxes on overtime pay (House version caps at $160,000).

Allows full interest deductibility for U.S.-assembled vehicle loans (limited to $10,000, phased out above $100k/$200k).

Adds $6,000 standard deduction per senior (65+) through 2028; phased out at higher incomes.

Increases child tax credit to $2,500 per family (through 2028, then $2,000 inflation-indexed).

Small Business and Investment Incentives:

Expands pass-through business deduction to 23% (House version; Senate retains 20%).

Reinstates 100% bonus depreciation for equipment, machinery, and R&D (retroactive to Jan 19, 2025).

100% expensing for new factory construction and improvements.

Raises expensing cap to $2.5 million for capital investments.

Expands QSBS exclusions: $75M asset limit and $15M capital gains exemption.

Reinstates competitive interest deduction for domestic investment.

Raises 1099-MISC threshold to $2,000; repeals 1099-K gig economy rule.

Trump Savings Accounts:

Creates tax-deferred savings accounts for newborns (up to $5,000/year, inflation-indexed post-2027).

Energy and Deregulation:

Repeals Biden-era green energy tax credits (EVs, home systems, GGRF), saving $600–$700B over 10 years.

Phases out wind and solar credits; prioritizes nuclear, hydro, geothermal.

Reforms 45Q carbon capture credit (inflation-indexed, rate-equalized).

Requires quarterly oil/gas lease sales; restores pre-IRA royalty rates.

Suspends natural gas tax for a decade.

Establishes CEQ opt-in fast-track for fossil fuel permitting.

Fiscal Discipline and Spending Reforms:

Eliminates EV subsidies ($200–$250B savings).

Adds $250 annual EV registration fee ($75–$125B revenue).

Cuts $1.6T in mandatory spending—largest in U.S. history.

Includes work requirements for Medicaid/SNAP (80 hrs/month).

Tightens Medicaid eligibility/reduces retroactive coverage.

Lowers Medicaid provider taxes (6% → 3.5% by 2033).

Requires states to share SNAP costs (5%–15% of benefits, 75% of admin).

Ends tax benefits for undocumented immigrants (e.g., Obamacare, Medicare).

Imposes 1% remittance tax.

Projected Economic Impact:

Real GDP +4.2%–5.2% over 4 years; +3.5% long term (House Ways & Means).

Median-income families gain $4,000–$5,000 in after-tax income.

Worker wages rise $2,100–$3,300 on average.

Creates 7M jobs in 4 years (1M from small business relief, 2.8M from tariffs).

Border Security & Defense:

$46.5B for border wall (701 miles primary, 900 miles barriers).

$45B for ICE detention; $30B for 18,000 new personnel.

$150B for defense: missile shield, drones, unmanned vessels, AI systems.

Other Pro-Growth Measures:

$12.5B for air traffic modernization.

Expands HSAs; increases insurance flexibility.

Adds charitable deductions for non-itemizers ($1,000/$2,000).

Ends tax breaks for hedge fund-style nonprofits and billionaire-owned sports teams.

Provides disaster relief for farmers, ranchers, and producers.

I love how you explain all the benefits. I am upset at the 5 trillion in spending. Until

We stil spending and shrink debt, nothing is ever going to change. How do we fix that?

The tariffs are currently generating $2B a day, folks. And its growing. Realistically $1T per year is going to be the result. That equalizes through Trump's term what new spending occurs. And that's just the tariffs. Add to that what $10T in new manufacturing will generate, and the result is an economic tsunami win for the United States. Common sense here.