Market Euphoria Meets Reality: Risks, Valuations, and the Road Ahead

In a market propped up by sentiment and deficit spending, rising yields and inflated valuations threaten to upend expectations. Investors must tread carefully as the cracks in forecasts widen.

Today’s market selloff aligns with overly optimistic forecasts driven by exuberant investor sentiment responding to President Trump's pro-growth policies and subsequent Wall Street upgrades for next year’s S&P 500 targets.

Historically, markets tend to decline after the Federal Reserve initiates rate cuts, despite significant rallies preceding such actions. This highlights the prudence of reallocating some funds into risk-free money market instruments linked to short-term Treasury bills or notes. Currently, yields on these instruments exceed the S&P 500’s earnings yield due to the index’s market-cap-weighted structure, dominated by mega-cap stocks.

As of December 18, 2024, the 3-month U.S. Treasury bill yield stands at approximately 4.35%. In contrast, the S&P 500 earnings yield is around 3.33%. This comparison indicates that short-term Treasury bills are currently offering higher yields than the earnings yield of the S&P 500, suggesting that investors may receive better returns from these risk-free government securities compared to equities at present.

Despite today’s selloff, the economy remains resilient, with no imminent signs of recession. However, potential tax-related selling early next year may lead investors to lock in profits accumulated over recent years. Many may opt to sell early to manage long-term capital gains tax liabilities.

Market valuations are stretched, with the rising 10-year Treasury yield posing a significant risk. Since its September low of 3.7%, the yield has climbed to 4.5% — a 21.6% increase. This is particularly concerning given elevated market valuations.

Longer-Term Treasuries Take a Hit

For instance, the return on a 10-year Treasury bond, reflecting the yield rise from 3.7% in September to 4.5% today (December 18), is approximately -7.4%, factoring in the price decline due to the inverse bond price-yield relationship. Accounting for coupon payments and a three-month holding period, the total return improves to about -5.94%.

In these conditions, maintaining a steady investment approach is wise. Fundamentally undervalued stocks should remain as holds. Consensus forecasts predict 2.5% inflation-adjusted GDP growth next year, with the Federal Reserve signaling two additional rate cuts. However, a January rate cut seems unlikely given stronger-than-expected inflation and the Fed’s upward revisions to inflation and GDP projections.

The underlying fundamentals remain sound, suggesting potential rebounds after major selloffs. Intrinsic values and growth prospects for many stocks remain attractive. As the market adjusts to policy shifts, discipline and a focus on fundamentals will enhance recovery prospects.

The most immediate risk is the rising 10-year Treasury yield, which closed today at 4.5%, contributing to the market’s decline.

Exhibit: 10-Year Treasury Yield Trend

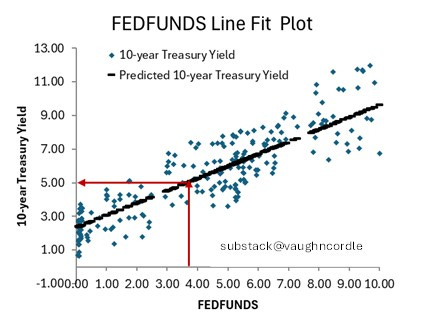

A regression analysis of 60 years of quarterly data indicates the 10-year yield could reach 5% or higher. An increase in this risk-free rate raises the cost of equity (ke), thereby elevating the investment hurdle rate. Conceptually, the inverse of ke determines the fair value P/E ratio or earnings yield. As yields rise, the fair value P/E ratio declines, requiring higher expected returns to justify current valuations.

This underscores the inverse relationship between interest rates and equity valuations: rising Treasury yields increase the required rate of return for the S&P 500, pushing valuations lower.

10-Year Treasury Note Yield Projections

The consensus estimates for the 10-year yield serve as a short-term sentiment indicator that can shift rapidly, yet they provide valuable insights. As the chart shows, the market anticipates yields may decline over the next two years before rising to around 5%. These lower expected yields have contributed to P/E ratios and the market reaching historic highs over the past two years.

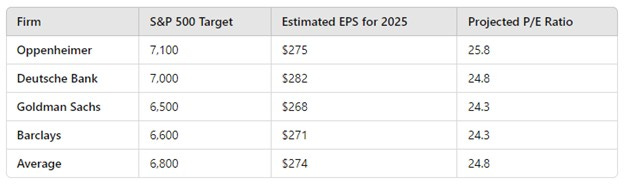

Based on the latest available data, here are the projected earnings per share and price-to-earnings (P/E) ratios for the S&P 500 in 2025, according to various Wall Street firms:

S&P 500 EPS and P/E Projections for 2025

These projections indicate that the S&P 500 may continue to trade at elevated valuation levels through 2025. Historically, if the 10-year yield rises further, these estimated P/Es are likely too high, particularly if earnings estimates fall short. The long-term average P/E is around 18x — nearly 27% lower than current levels — and a 10-year yield between 4.5% and 5% has historically been the norm. Elevated P/Es can be justified if earnings growth meets expectations, but consensus tends to be overly optimistic, especially at the end of long economic cycles.

Market Outlook Narrative:

Key Drivers:

Technological Innovation: The integration of artificial intelligence (AI) is expected to significantly boost productivity and profitability, drawing parallels to transformative technologies of the past.

Economic Growth: Analysts project continued expansion of the U.S. economy, with real GDP growth estimates around 2.5% for 2025.

Corporate Earnings: Forecasts suggest an 11% increase in corporate earnings, bolstered by technological advancements and potential fiscal policy changes.

Fundamentals:

Valuations: Current valuations are elevated, with the S&P 500's price-to-earnings ratio at approximately 25.75, translating to an earnings yield of about 3.88%.

Interest Rates: The 10-year Treasury yield stands at 4.5%, offering a higher risk-free return compared to the earnings yield of equities.

Risks:

Rising Bond Yields: If the 10-year Treasury yield rises to 5% or higher, it would make bonds more attractive and potentially leading to a market sell-off.

High Valuations: Elevated P/E ratios suggest that the market may be overvalued, increasing the risk of a correction.

Investor Behavior: The recent re-election of President Donald Trump, coupled with a Republican-controlled Congress, has invigorated investor sentiment, often referred to as "animal spirits." This renewed optimism is largely driven by expectations of pro-growth policies, including tax cuts and deregulation, which are anticipated to stimulate economic expansion and corporate profitability.

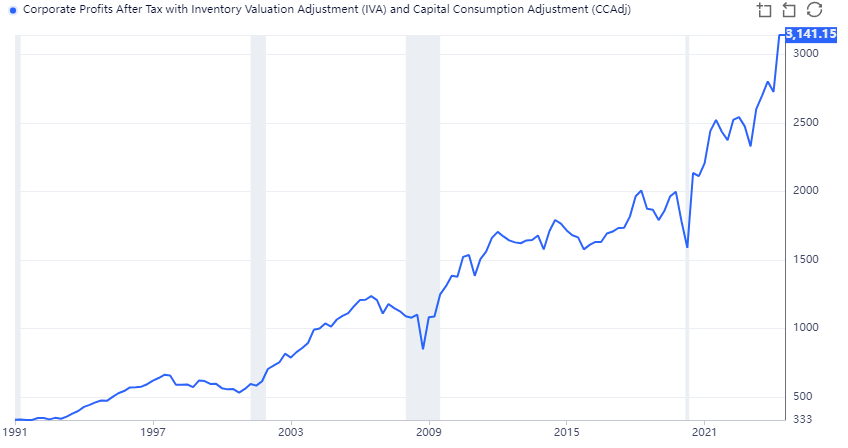

Corporate Profits

Corporate profits are inflated, driven in large part by excessive government spending, reflected in the $1.8 trillion deficit. Additionally, the wealth effect — stemming from inflated stock market and housing values — has led to a higher propensity to spend. If government spending is reduced, as Trump’s Department of Government Efficiency (DOGE) plans to do, the implication is a decrease in the government component of GDP, assuming all else remains constant, which is rarely the case.

Corporate profits, including both public and private companies, stand at $3.24 trillion, based on the latest annualized reading from the Bureau of Economic Analysis for the third quarter of 2024. This reflects a year-over-year growth of 16.38%, significantly higher than the historical growth rate of 5.4% (2Q 1984 through 3Q 2022), excluding the last two years of high inflation and excessive government spending, when using the same CCAdj measure.

Corporate Profits After Tax with Inventory Valuation Adjustment (IVA) and Capital Consumption Adjustment (CCAdj):

Wall Street S&P 500 Forecasts for 2025

Wall Street analysts have provided various forecasts for the S&P 500's performance by the end of 2025. As of December 16, 2024, the S&P 500 Index stood at approximately 6,080. Following today’s selloff, the index stands at 5,872, down 2.95%.

These firms expect a 9.9% return on the S&P 500 Index by the end of 2025. The assumption, based on market consensus, is that the 10-year yield will be in the mid-to-high 3% range. This may be unrealistic given higher-than-expected inflation and the Fed’s announcement today that the Fed Funds rate will be cut only two times (50 basis points) versus their previous plans to cut four times.

Wall Street consensus estimates are consistently inaccurate. For example, in December 2023, these same firms projected the S&P 500 would reach, on average, 5,100 by the end of 2024. As of December 16, 2024, they underestimated the index by 16%. What they failed to account for was the surge in consumer spending driven by the wealth effect and nearly $2 trillion in government deficit spending. Historically, over the last four business cycles, Wall Street’s consensus has tended to be overly optimistic by more than 10% over a full cycle.

Conclusion

While Wall Street consensus projects continued growth in the S&P 500 through 2025, significant risks remain. The rising 10-year Treasury yield, which could surpass 5%, threatens current market valuations by increasing the cost of equity and lowering fair-value P/E ratios. Elevated P/E levels may prove unsustainable if earnings growth fails to meet optimistic expectations, especially given consensus forecasts' historical tendency to be overly rosy at cycle transitions.

Consensus forecasts rarely reflect reality, particularly for year-ahead projections. Sell-side analysts and Wall Street firms advising financial advisors face inherent conflicts of interest. Their compensation depends on assets under management, incentivizing them to keep clients fully invested, regardless of market conditions. Additionally, sell-side analysts — working for firms underwriting debt and equity — are predisposed to bullish estimates. Companies issuing equity often favor underwriters with the highest target prices, reinforcing this optimistic bias.

Furthermore, there is a risk of economic contraction over the next year, with profits currently growing well above historical rates. Corporate revenue and earnings are tied to economic growth over the long term, and this risk could be amplified if the 10-year yield continues to rise in the near or intermediate term. Higher yields increase borrowing costs, hinder business investment, and strain consumer spending, all of which could dampen corporate performance. Inflation also poses a threat if it exceeds current expectations.

Given these dynamics, investors should remain vigilant and diversified, balancing exposure to undervalued equities with allocations to lower-risk instruments. Trump's America First agenda, including higher tariffs, may introduce additional short-term volatility. Nevertheless, disciplined investors who focus on fundamentals and maintain a strategic approach will be better positioned to navigate challenges and capitalize on opportunities during major market selloffs.