The U.S.-China Trade War: A Battle Against a Communist Foe

With 104% tariffs, Trump aims to strangle China’s economic lifeline—our $310 billion deficit—starving its military while shifting costs to benefits for U.S. households.

Trump’s 104% tariffs on China aim to choke a communist regime’s economic lifeline—funded by America’s $310 billion trade deficit—starving its military rise while shifting short-term pain on households and corporations into long-term gains for middle America, proving we shouldn’t bankroll a foe that undermines democracy. This essay argues the trade war with China is a vital move to defund a dangerous enemy.

The U.S.-China Trade War: Confronting a Communist Adversary

The U.S.-China trade war ignited a full-blown clash on April 9, 2025, when President Donald Trump’s 104% tariffs on $460 billion of Chinese imports took effect at midnight EDT, met within hours by China’s retaliatory 84% tariffs on $140 billion of U.S. exports, effective April 10. This isn’t a petty trade spat—it’s a high-stakes fight against a communist regime that’s no ally to America or democracy. China unleashed COVID-19, steals $225–$600 billion in U.S. intellectual property annually, exploits slave labor, and crushes free speech with iron-fisted censorship and media control. America’s dollars shouldn’t fuel this enemy, which leverages our trade deficit to arm its military and erode democratic values globally. What follows is a no-nonsense dive into what a sustained trade war means for corporate America and average households—costs, pivots, and why cutting China’s economic lifeline trumps all.

Section 5: The U.S.-China Trade War: What It Means if It Holds

Trump’s 104% tariffs on $460 billion of Chinese imports, effective April 9, 2025, and China’s 84% counterstrike on $140 billion of U.S. exports the next day, have ignited a trade war that could redraw America’s economic and strategic map. This isn’t about haggling over trade—it’s about survival against a communist foe that turns U.S. trade deficits into military might and economic leverage against democracies. If these tariffs endure, they’ll generate revenue to choke China’s ambitions, hammer corporate America short-term, and spike household costs that ease over time, all while spotlighting how decades of trade imbalances built China into a military powerhouse. Here’s the raw truth.

Revenue: Starving the Dragon

The U.S. could pocket $250 billion (worst case) to $340 billion (base case) to $410 billion (best case) in 2025 from these tariffs (See Exhibit C). In the base case, imports fall 25% from $460 billion to $345 billion as prices jump, delivering $359 billion gross—$340 billion net after enforcement costs. That’s $1 trillion over four years, cash for factories or tax relief, not Beijing’s war chest. China’s $310 billion trade surplus with the U.S. (1.59% of its $19.5 trillion GDP, See Exhibit A) has fueled its $250 billion military budget, powering hypersonic missiles and cyberattacks like the 2023 U.S. grid breaches. If tariffs hold, that $340 billion in revenue hits China’s 2.36% GDP export reliance—five times the U.S.’s 0.49%—starving its growth. Their 84% retaliation claws back $117.6 billion, but it’s a weaker swing against America’s $359 billion blow. Trump’s claim of $7 trillion in foreign investment—think Japan or South Korea building U.S. plants—could offset some deficit pain long-term, though it’s not instant cash but a slow-build lifeline.

Inflation: The Short-Term Sting

If tariffs stick, inflation hits households fast, from U.S. tariffs on Chinese imports and China’s retaliation. Here’s the 2025 estimate for 131 million U.S. households:

Worst Case: Imports drop 45% to $253 billion; 70% pass-through. U.S. cost = $263 billion; consumer share = $184.1 billion. China’s 84% on $140 billion = $117.6 billion; consumer share = $82.3 billion (70%). Total = $266.4 billion ÷ 131M = ~$2,033/year.

Base Case: Imports fall 25% to $345 billion; 50% pass-through. U.S. cost = $359 billion; consumer share = $179.5 billion. China’s retaliation = $58.8 billion (50%). Total = $238.3 billion ÷ 131M = ~$1,649/year.

Best Case: Imports decline 10% to $414 billion; 30% pass-through. U.S. cost = $431 billion; consumer share = $129.3 billion. China’s retaliation = $35.3 billion (30%). Total = $164.6 billion ÷ 131M = ~$1,256/year.

The base case—$1,649/household—means $238.3 billion in 2025 costs: $179.5 billion from Chinese goods (52% import inflation) and $58.8 billion from China’s hit on U.S. exports like soybeans, pushing up food and fuel. That’s $1,800 iPhones and 20-cent/gallon gas hikes—but it fades to $800–$1,000 by 2028–2030 as markets shift:

Importer Absorption: Walmart and Apple eat 30–50% of the 104% hike ($100 item at $150–$170, not $204).

Supply Pivot: China’s 14% U.S. import share shrinks as Mexico (up 26% since 2017), Vietnam, India, Philippines, and Indonesia step in—not just Brazil’s soybeans.

Dollar Strength: A 5% yuan drop since January 2025 cuts $70/household, with more likely.

U.S. Production: Stellantis cuts Chinese parts 20%; Toyota’s $10 billion Kentucky plant grows.

Competition: Middlemen and U.S. suppliers (95% lumber domestic) cap spikes.

China’s 84% hit—$13.4 billion soybeans, $14.7 billion fuels—adds pressure, but pivots to India or Vietnam soften it over time.

Corporate America: Wall Street’s Pain, Main Street’s Win

S&P 500 firms, with 30% foreign revenue (2023), get slammed. The 104% tariffs inflate costs—Apple’s $70 billion China revenue faces pricier iPhones or India shifts (14% output there)—while China’s 84% tariffs and rare earth curbs gut exporters. The S&P 500 wobbles, down 3% post-April 9, with a 2-3% EPS hit (Goldman Sachs). Corporate America bleeds short-term—Apple scrambles, Wall Street whines—but adapts. Households gain long-term: 500,000 manufacturing jobs by 2030 (Oxford Economics) as firms reshore. Trump’s $7 trillion foreign investment estimate could offset some deficit sting if Japan, South Korea, or others build here, turning corporate pain into Main Street jobs—China’s 2.5 million surplus-funded jobs (See Exhibit A) shift back to America.

Foreign Investment: Companies Responding to Tariff Incentives

Trump’s tariff policies are incentivizing foreign companies to invest in U.S. manufacturing, redirecting billions to bolster American production. Japan’s Toyota is committing $10 billion to expand its Kentucky plant, while Taiwan’s TSMC is pouring $100 billion into Arizona semiconductor factories. South Korea’s Hyundai plans a $20 billion investment, including a new steel plant in Louisiana, and Samsung is eyeing a shift of dryer manufacturing from Mexico to South Carolina. Germany’s Volkswagen is exploring U.S. sites for its Audi and Porsche brands, and Sweden’s Volvo Cars may follow suit, bolstered by Trump’s $7 trillion estimate of potential foreign investment from Mexico, Vietnam, and beyond. These moves signal a manufacturing pivot, driven by tariffs that make U.S.-based production a smarter bet than imports.

Military Muscle: Deficit-Fueled Might

America shouldn’t fund a regime that turns our dollars into threats. The $310 billion trade deficit has armed China—at $20,000 per soldier, its 2.035 million conscripts cost $40.7 billion, versus $271.8 billion for the U.S.’s 1.359 million volunteers at $200,000 each. China drafts cheap labor; the U.S. pays for an all-volunteer force with benefits. Exhibit D proves the edge:

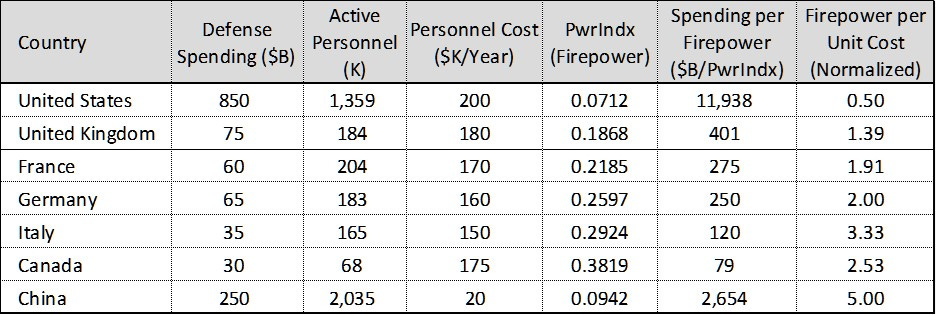

Exhibit D: Firepower per Unit Cost (2025 Estimates)

China’s $250 billion—lean at 1.28% of GDP, outpacing NATO in efficiency (See Exhibit E)—delivers 5x the firepower per dollar, eyeing Taiwan with trade surplus cash turned into missiles and carriers. The U.S. deficit didn’t just lose 5.8 million jobs post-WTO (See Exhibit A); it built a rival ranked 3rd globally (Global Firepower 2025).

Why It’s Worth It: Defunding a Threat

China’s military, efficient at 1.28% of GDP, threatens democracies while stealing $225–$600 billion in IP yearly. Its slave labor and censorship export tyranny, not trade fairness. Tariffs hit its 2.36% GDP export reliance—five times the U.S.’s 0.49%—with $340 billion in revenue starving its growth. Households take a $1,649 hit in 2025 that fades to $800, trading pain for 500,000 jobs and a weaker foe. Corporate America adapts—S&P 500 steadies, Apple pivots—bolstered by $7 trillion in potential investment from Mexico, Vietnam, or beyond. It’s a fight to stop funding a regime that turns our dollars into threats.

A Trump tweet a day keeps the margin clerk’s at bay: https://kingcambo812.substack.com/p/fear-and-loathing-in-trader-hell-075

I agree, starve them. China is not our friend.