Trump’s Big Beautiful Bill Act: July 4th Updates and Economic Revisions

Trump’s July 4th Gift to the Nation: A Reality Check on GDP Growth Projections.

This updated list reflects four minor revisions to Appendix A: Key Provisions of the OBBBA, from my report Trump’s July 4th Gift to the Nation. It also includes a rough estimate of key economic metrics, combining data from reputable sources with my own ballpark—but reasonable—projections.

The House Ways and Means Committee’s real GDP projections are likely overstated, based on assumptions of minimal trade retaliation, permanent tax provisions, and limited debt effects. Dynamic scoring from the Tax Foundation, Penn Wharton, CEA, and Heritage offers a more grounded view—but still understates tariff revenue and the added lift from regulatory cuts and other pro-growth policies.

To reduce numerical clutter, I’m using mid-point estimates for clarity. These figures are illustrative and will likely diverge from actual outcomes. This is a discovery-driven analysis—anchored in today’s assumptions, refined as new data emerges. The goal is not precision, but understanding what drives the numbers.

The House Committee projects 4.7% GDP growth in four years, 3.5% by 2035, and 7 million new jobs. These are inflated. A more realistic view, grounded in dynamic modeling, forecasts 2.5% GDP growth over four years, 2% by 2035, and 5.4 million jobs.

The Tax Foundation and Penn Wharton overstate the deficit at $3.9 trillion by excluding $450 billion in regulatory savings and $3.5 trillion in tariff revenue (over 10 years), while overstating interest costs at $1.5 trillion and debt-to-GDP at 125.5%. A more reasonable estimate puts the deficit closer to $3.15 trillion, interest at $1.3 trillion, and debt-to-GDP around 120% in 10 years. The CBO’s static model—which projects a $4.9 trillion deficit and 1.8% GDP growth—ignores the dynamic effects of investment, tax relief, tariffs, and deregulation.

The OBBBA’s tax relief, industrial investment, and deregulatory push will drive growth. Yes, debt and trade risks remain. It’s not perfect. But it’s a serious first step—a blueprint for restoring long-term prosperity.

The following outlines the key pro-growth provisions of the One Big Beautiful Bill Act (OBBBA) of 2025, passed by Congress and signed into law on July 4, 2025, designed to ignite economic growth, expand investment, create jobs, and impose fiscal discipline.

Permanent Extension of 2017 Tax Cuts and Jobs Act (TCJA):

Permanently extends individual income tax rate reductions, preventing a $4 trillion tax hike.

Increases standard deductions to $16,000 (individuals), $24,000 (heads of households), and $32,000 (married couples) through 2028, indexed for inflation thereafter. Updated to reflect Senate’s final figures.

Raises the state and local tax (SALT) deduction cap to $40,000 for incomes below $500,000, increasing 1% annually through 2029, reverting to $10,000 in 2030.

Increases estate tax exemption to $15 million (singles) and $30 million (married filing jointly), indexed for inflation.

New Tax Relief Provisions:

Eliminates taxes on tips up to $25,000 annually (through 2028, phasing out at $150,000/$300,000 for single/joint filers).

Eliminates taxes on overtime pay up to $12,500 (singles)/$25,000 (joint) through 2028, phasing out at $150,000/$300,000.

Allows deduction of interest on loans for U.S.-assembled vehicles up to $10,000 (through 2028, phasing out by $200 per $1,000 above $100,000/$200,000).

Increases standard deduction by $6,000 per individual aged 65+ (through 2028), benefiting 33.9 million seniors with an average after-tax income increase of $670; phases out at 6% above $75,000 (singles)/$150,000 (joint), fully at $175,000/$250,000. Updated to $6,000 from House’s $4,000 proposal.

Increases child tax credit to $2,200 per child (permanent, $1,700 refundable in 2025, indexed from 2026). Updated to reflect Senate’s $2,200.

Small Business and Investment Incentives:

Makes Section 199A deduction permanent at 20% for pass-through businesses, creating 1 million jobs annually. Updated to 20% from House’s 23% proposal.

Reinstates 100% immediate expensing for equipment, machinery, and domestic R&D (retroactive to January 19, 2025).

Allows 100% expensing for new factory construction and improvements.

Increases expensing cap to $2.5 million for capital investments.

Expands qualified small business stock (QSBS) program: raises asset threshold to $75 million and capital gains exclusion to $15 million.

Reinstates globally competitive interest deduction for domestic investments.

Increases 1099-MISC threshold to $2,000 and repeals 1099-K rule for gig economy transactions over $600.

Trump Savings Accounts:

Creates tax-deferred accounts for newborns with a $1,000 federal deposit (2025–2028) and parental contributions up to $5,000 annually (indexed post-2027), with earnings taxed as capital gains upon qualified withdrawal. Updated to include $1,000 federal deposit.

Energy and Deregulation Policies:

Repeals Biden-era green energy tax credits (e.g., EV credits, home EV charging, energy-efficient systems, Greenhouse Gas Reduction Fund), saving $600–$700 billion over 10 years.

Phases out wind and solar tax credits (60% in 2026, 20% in 2027, 0% in 2028), boosting nuclear, geothermal, and hydropower.

Improves 45Q carbon capture credit by indexing to inflation and equalizing rates.

Requires quarterly oil and gas lease sales, reduces royalty rates to pre-IRA levels, and ensures timely federal coal leasing.

Pauses IRA’s natural gas tax for 10 years.

Establishes opt-in program for expedited environmental reviews, streamlining fossil fuel project permits.

Fiscal Discipline and Spending Reforms:

Eliminates EV subsidies, saving $200–$250 billion over 10 years.

Introduces $250 annual EV registration fee, raising $75–$125 billion over 10 years.

Cuts $1.6 trillion in mandatory spending, including:

Work requirements for able-bodied Medicaid and SNAP recipients (ages 19–64, 80 hours/month, exemptions for children under 14). Updated to reflect Senate’s under-14 exemption.

Twice-yearly Medicaid eligibility verifications and one-month retroactive coverage.

Lowers Medicaid provider taxes from 6% to 3.5% by 2033, with $50 billion rural hospital stabilization fund.

Requires states to pay 5%–15% of SNAP benefit costs (2028, high-error-rate states >6%) and 75% of administrative costs.

Eliminates tax credits and benefits for undocumented immigrants (e.g., Obamacare premium credits, Medicare) and imposes 1% remittance tax.

Economic and Job Growth Projections:

Increases real GDP by 4.2%–5.2% over four years and 3.5% long-term, driven by tax cuts, investment, tariffs, and deregulation (House Ways & Means).

Delivers $4,000–$5,000 in additional take-home pay for median-income families with two children and $2,100–$3,300 in higher wages per worker.

Creates 7 million jobs over four years, including 1 million from small business relief and 2.8 million from tariffs.

Border Security and Defense Investments:

Allocates $46.5 billion for border wall construction (701 miles primary, 900 miles river barriers, 629 miles secondary, 141 miles vehicle/pedestrian barriers).

Provides $45 billion for ICE detention capacity and $30 billion for hiring 10,000 ICE personnel, 5,000 customs officers, and 3,000 Border Patrol agents.

Includes $150 billion for defense, including $25 billion for Golden Dome missile-defense shield, $34 billion for shipbuilding, $21 billion for munitions, and funds for unmanned ships, drones, and AI.

Other Pro-Growth Provisions:

Modernizes air traffic control with $12.5 billion.

Expands health savings accounts and health coverage flexibility.

Increases charitable deductions for non-itemizers ($1,000 for single filers, $2,000 for joint filers).

Ends tax breaks for large nonprofits resembling hedge funds and billionaire sports team owners.

Provides disaster recovery funding for farmers, producers, and ranchers.

Sources

House Ways and Means Committee

White House

Tax Foundation

Penn Wharton Budget Model

Congressional Budget Office

Committee for a Responsible Federal Budget (CRFB)

Heritage Foundation

J.P. Morgan

Council of Economic Advisers (CEA)

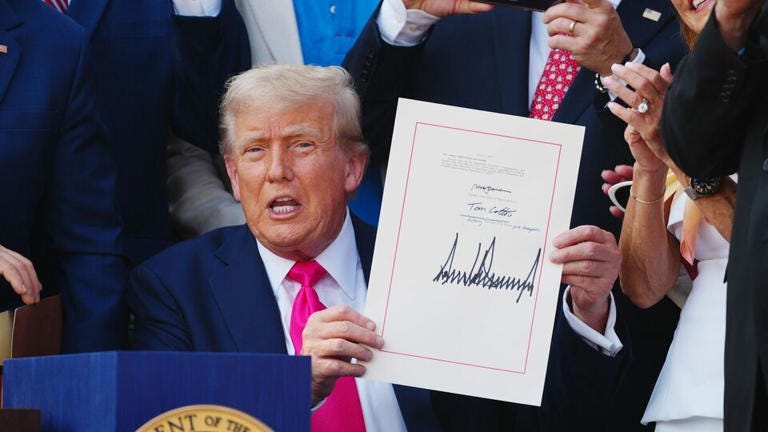

IMAGE: US President Donald Trump displays the signed bill during a ceremony for the One Big Beautiful Bill Act on the South Lawn of the White House in Washington, DC, US, on Friday, July 4, 2025. Trump signed his $3.4 trillion budget bill into law Friday, enshrining an extension of tax cuts, temporary new breaks for tipped workers and funding to crack down on illegal immigration.

👍